December 31, 2020

We understand that most clients value the importance of managing investments on a tax-efficient basis. While decisions in your portfolios continue to adhere to our disciplined investment process, we can also take opportunities to manage them tax efficiently. We achieve this in three main ways: working closely with you to discover your tax situation; tailoring your portfolio to best suit your tax needs and account structure; and managing capital gains from pooled fund investments annually.

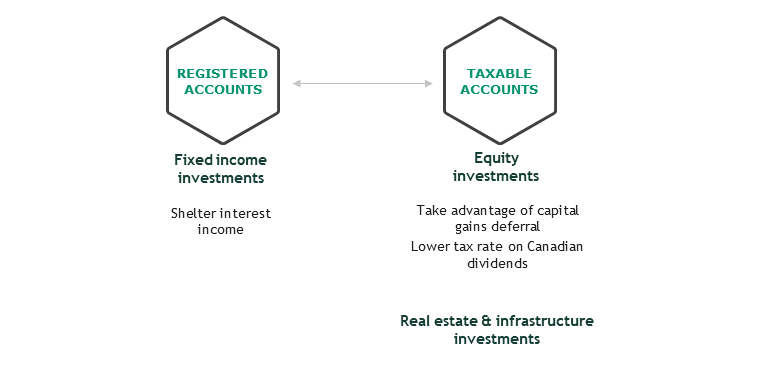

We manage each client’s total assets across all their registered and taxable accounts to efficiently locate assets with different tax attributes that would most effectively maximize the after-tax return.

Tax-efficient account allocation

We regularly review and identify opportunities to manage unrealized gains or losses within our clients’ taxable accounts, taking a customized approach to each situation.

We can take opportunities to manage your portfolios tax efficiently while adhering to our disciplined investment process.

Clients also benefit from our timely, accurate and thorough tax reporting. Each client receives a Taxable Accounts Expense Report from CC&L Private Capital, T3, T5008 and/or T5 tax slips from our custodians, and our Tax Facts supporting publication. Furthermore, we have client records of deductions or prior capital losses, which can be used to manage future capital gains.

Finally, we work with our clients’ trusted advisors to ensure that all authorized parties have all the relevant information to best look after your interests.

Want to learn more?

If you want to find out more about how we can tax-efficiently steward your wealth, please get in touch.