July 26, 2023

Our Canadian equity and fixed income investment management teams say that housing has been remarkably strong, but the factors providing support are not likely to offset the impact from interest rate hikes

Canadian home resales saw a consistent increase for four consecutive months to May, with home sales transactions up 1.4% from a year ago. This marks the first time since mid-2021 that home sales have shown positive annual growth. The increase is observed

across various regions in Canada, with more than 75% of local markets experiencing growth compared to last year.

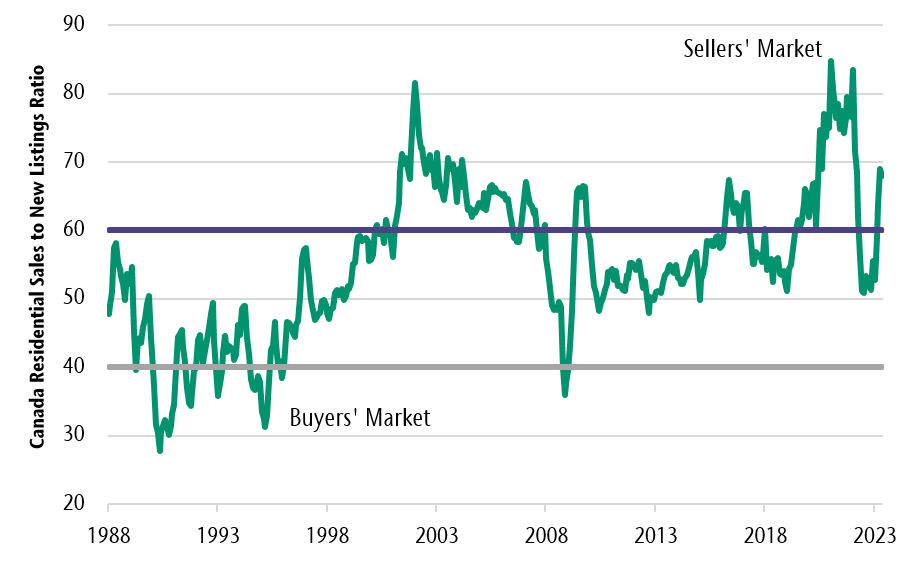

Low number of listings imply a return to sellers’ market

The stability of housing markets has been remarkable, defying the conventional wisdom that a more indebted country like Canada would be more vulnerable to higher interest rates. While savings, employment, asset values and immigration demand have all supported

the real estate market to date, they will not fully offset the impact of rising debt servicing costs as excess savings dwindle. Our Canadian equity and fixed income investment management teams still believe a recession still lies ahead, with the potential

silver lining that the Bank of Canada may have less work to do going forward.

Canadian equity and fixed income portfolio strategies

While the cyclicality of housing lends itself well to predicting economic cycles, various financial flows and consumer preferences have prevented housing markets from experiencing the full effects of higher interest rates, which has posed a challenge

for central banks. Indeed, Canada’s economic resilience is particularly noteworthy considering high household debt levels. However, the link between higher rates and an economic slowdown, although delayed, is unlikely to be eliminated. Historical

trends show that unemployment rates tend to remain low until the onset of a recession and even a 0.5 percentage point increase can trigger a recession. The renewed efforts by central banks to further raise rates at this stage of the tightening cycle,

while suggesting the need for sustained high rates, increase the risk of a hard landing.

As a result, our Canadian equity investment management team anticipates declining profit margins as wages continue to add pressure and pricing power diminishes. Consequently, it maintains a cautious outlook for equities and expects weaker earnings in

the upcoming quarters. In Canadian equity portfolios, it favours companies that are likely to consistently deliver earnings in a low-growth environment. At the same time, the team continues to search for companies whose valuations reflect the anticipated

slowdown or align with its secular themes, such as rising business capital expenditure. The latter includes companies involved in rebuilding supply chains and advancing the transition to green energy sources.

In fixed income portfolios, our investment management team has started to position for a broader steepening of the yield curve while maintaining an underweight exposure to credit. Both of these positions should benefit portfolios as a recession approaches.

While the economic stability has been welcomed, market optimism suggests that it will continue. In the view of our Canadian fixed income investment management team, the downside risks are gathering pace.

You can read further details from our Canadian equity and fixed income investment management team here.