December 07, 2023

As the year-end approaches, many people start thinking about giving back. Recognizing that charitable donations can provide tax benefits and help with estate planning is important.

Giving rules of thumb

So, how do you make the most of your giving? Often, people make ad-hoc donations to charity from their chequebooks or taxable accounts. While all donations are great, there are a few giving strategies to keep in mind that can benefit charity and reduce

your tax bill.

1. Giving appreciated securities is better than making cash donations

Why? Not only will you benefit from a tax credit on your donation, but you will also remove the embedded taxes owing within your donated security (and can replace it immediately).

2. Donor Advised Funds (DAFs) can be beneficial if you plan to give over time while growing the assets earmarked for charity

That is if you can take advantage of the large tax credit by contributing future donations to your DAF as an upfront lump sum. Tax-free growth within a DAF ultimately leads to greater wealth transfer to charity over time.

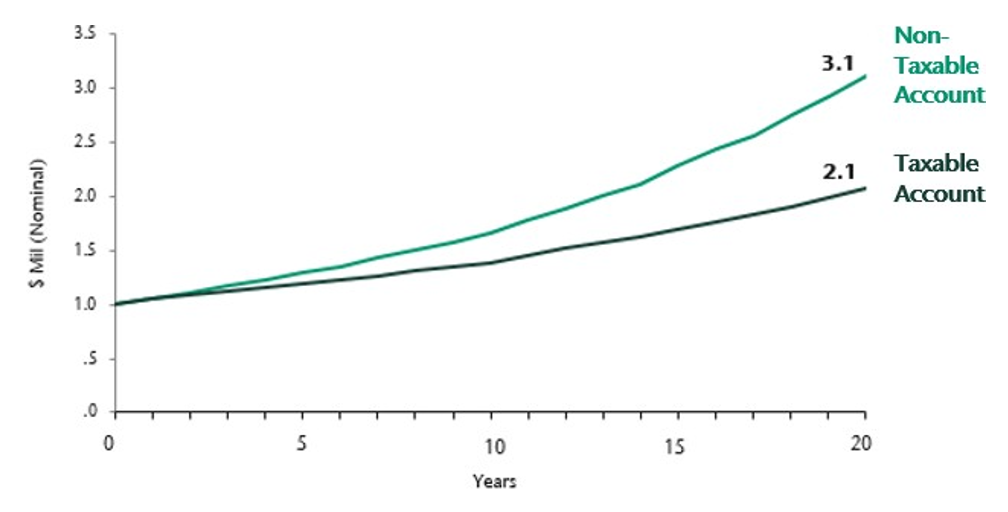

The 'Quantifying the Value of Tax Exemption' chart demonstrates the benefit of tax-free growth. Suppose we have two investors with $1.0 million each. Person A opens a tax-free account, while Person B opens a personal taxable account in British Columbia. Assuming both people implement a balanced asset mix (45% fixed income, 55% equity) and do not spend from their portfolios, we expect Person A to accumulate 47% more wealth over the next 20 years due to tax exemption.

Quantifying the Value of Tax Exemption**

Additionally, if you have a RRIF and do not require annual distributions, you might consider donating your mandatory RRIF payments to charity in exchange for tax credits. RRIF withdrawals are included in taxable income and are taxed at marginal rates. Depending on your unique tax situation and province, donation receipts from RRIF distributions to charity can offset (or more than offset) taxes owing on registered account withdrawals.*

Proposed tax changes

There are a few upcoming proposed tax changes that could negatively impact some high-income donors. In the few cases where Alternative Minimum Tax (AMT) applies, wealthy donors could face higher capital gains inclusion rates and lower tax credits on donated public securities.***

Donors with high incomes should speak to their accountants about the size and timing of upcoming donations. In cases where AMT applies, charitable donations this year could be more tax advantageous than in the future.

Community needs are high

Recently, more Canadians have been relying on charitable services while fewer people are giving to charity. Why the disconnect?

Lasting pandemic impacts and higher living costs have led to an increased demand for charitable services. According to CanadaHelps, an alarming 22% of Canadians expect to rely on charitable services for their basic needs (up from 14% in January 2022). At the same time, inflationary pressures and economic uncertainty have resulted in fewer people making charitable donations. The donor participation rate (i.e., the percentage of households that claim charitable donations on tax returns) has declined across all household income levels and ages.****

The good news? While fewer people donate, the monetary size of donations (typically made by wealthy Canadians) has grown. From 2010 to the end of 2020, actual dollars donated increased 28%.****

'Tis the season

Charitable donations are mutually beneficial. They are a great way to support the causes that are meaningful to you, and they may also reduce your tax bill when a tax-efficient donating strategy is employed. Giving back gives back.