April 07, 2022

Markets overview

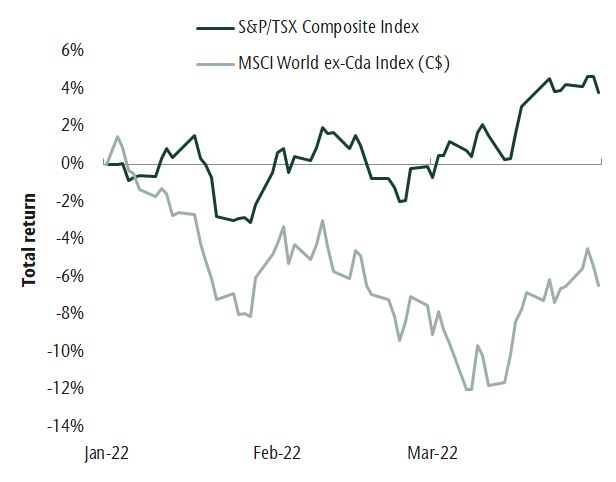

This quarter we experienced large divergences in asset performance. In particular, core bonds are experiencing their worst decline in over 25 years. At the forefront, economic growth is slowing, albeit from high levels. As this occurs, investors increase focus on accelerating inflation, the Russian war impact on commodity prices and rate increases from central banks. This resulted in increased market volatility and mixed results for equities. The MSCI World ex. Canada Index (C$) was down -6.4% and the S&P/TSX Composite Index increased by 3.8%. This divergence in performance can be explained by significant differences in the sector weights between the two markets. The S&P/TSX Composite has a much larger weight to the energy sector which benefited from higher commodity prices. Further, the Canadian index has a much lower weight to technology and consumer discretionary sectors which are both negatively affected by higher interest rates and inflation.

Equity returns are volatile in Q1

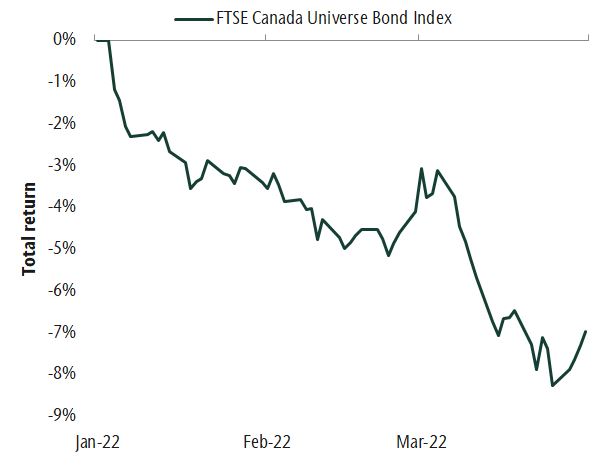

Bond returns moved sharply negative as investors priced in more central bank rate increases to contain inflation. The FTSE Canada Universe Bond Index was down -7.0% this quarter. This extends the decline from last year where the benchmark was down -2.5% for the year. This is a reversal in the strong gains experienced in the bond market as yields fell in prior years. As core bonds have declined, short term and high yield bonds have done better because they are less sensitive to increases in yields.

Bonds have fallen sharply

Portfolio strategy

Lingering supply-chain disruptions, high commodity prices and geopolitical risk means inflation may be here for longer. In response, central banks are increasing interest rates several times this year. Given this, our portfolio management teams have added to businesses that can pass on increased costs and selectively bought companies that can benefit from higher commodity prices. We have a bias to high-quality companies that can navigate a more challenging backdrop.

In client portfolios we reduced the allocation to equity as financial conditions are becoming less accommodative and economic growth is slowing. This is a less-supportive and more volatile environment for equities than earlier in the cycle. Within equities we favor Canadian stocks, which offer good growth prospects, underscored by strong commodity prices and reasonable valuations. We continue to believe short and high yield bonds are more attractive than core bonds and are positioned accordingly.

From the desk of Jeff Guise, Managing Director, Chief Investment Officer, CC&L Private Capital.